Once again, we tapped into our network of super smart healthcare friends to conduct a pulse-check of sentiment and perspectives around hot topics in healthcare. Looking back at last year’s wisdom of the (intelligent) crowd, we missed on several fronts believing that the Fed rates would have dropped by now and only a quarter of us were optimistic that the stock market would end the year up. We were also way off on Ozempic, predicting disillusionment after early adoption.

Looking at 2024 views, GLP-1s are firmly consensus, with ever broader clinical benefits, while CMS is expected to make even more headway with drug price negotiations. In the less exciting camp, “talk not translating to action” by the FTC remains the norm - but how about those non-competes! Contrary to last year, almost three quarters of us anticipate a good year for the stock market… three cheers for the optimists!

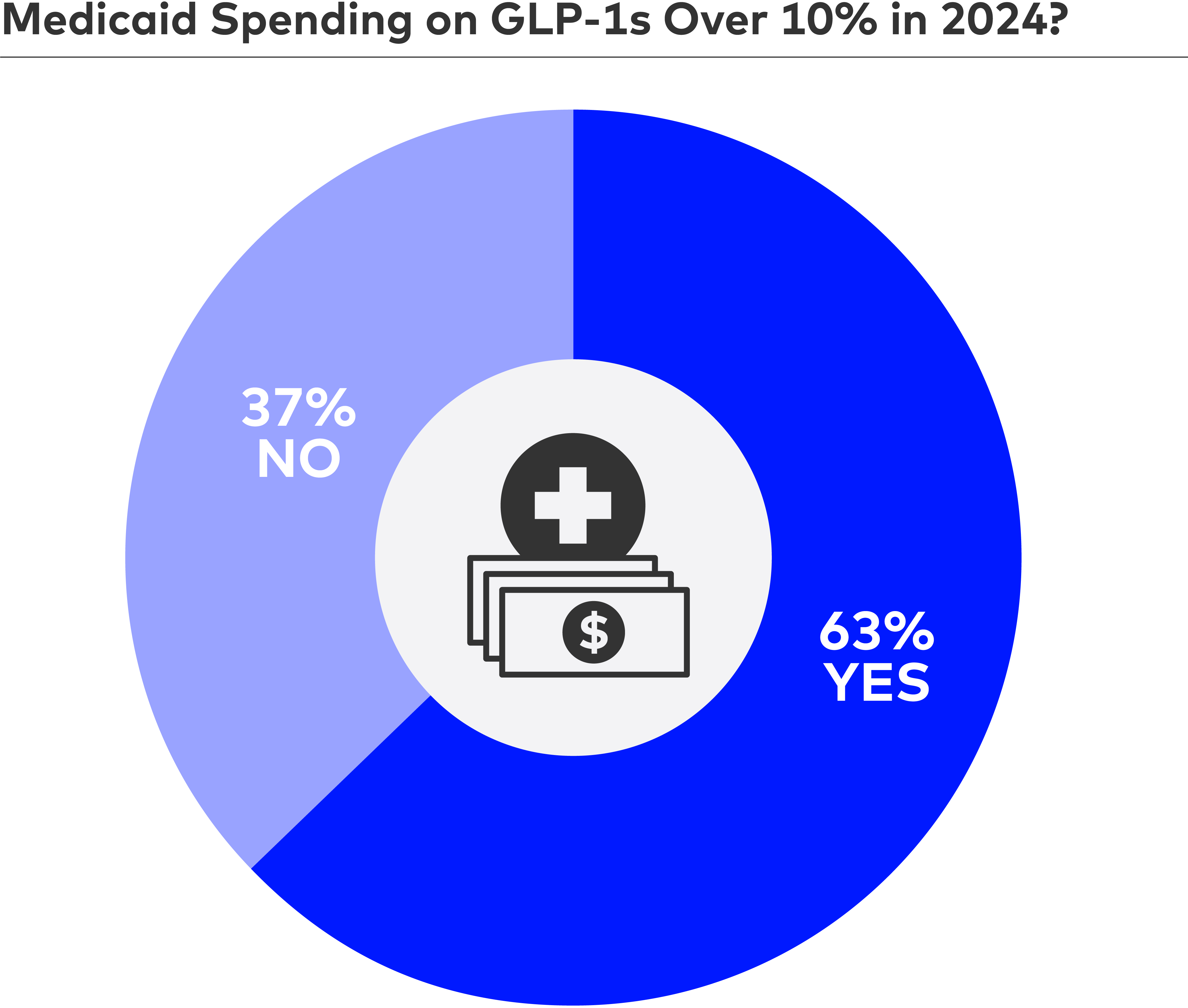

In addition, after our survey closed, Arizona’s state Supreme Court applied a 160-year old law to ban nearly all abortions. While the state legislature swiftly repealed said ancient law, it feels like we can pretty confidently call the prediction early that reproductive rights will continue to erode in many states, and give it to the 63% “yes” votes.

Below is our synthesis of the most interesting findings from this year’s survey, along with the full results.

THE POST-COVID ERA

Four years after the pandemic lockdown, we’ve collectively moved on. People are treating Covid like the flu and companies are bringing employees back to the office in droves. How’s that going?

COVID CONCERNS?

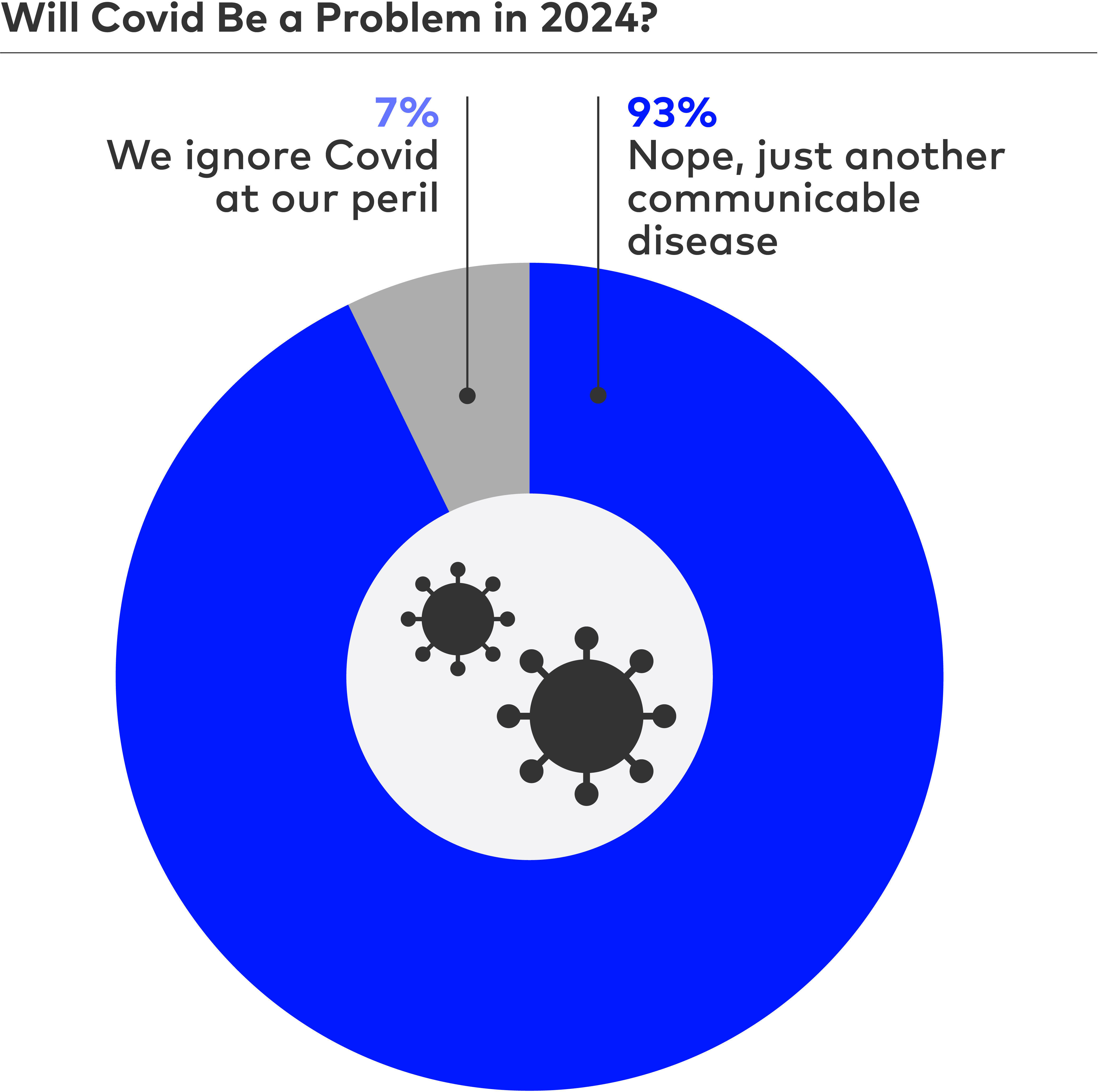

Last year, only 9% of respondents thought we’d see another disruptive variant of Covid. So far, the majority was right, and now nobody seems to care about Covid anymore. It may jinx us, but maybe there is not even a Q about it in 2025…

THE OFFICE

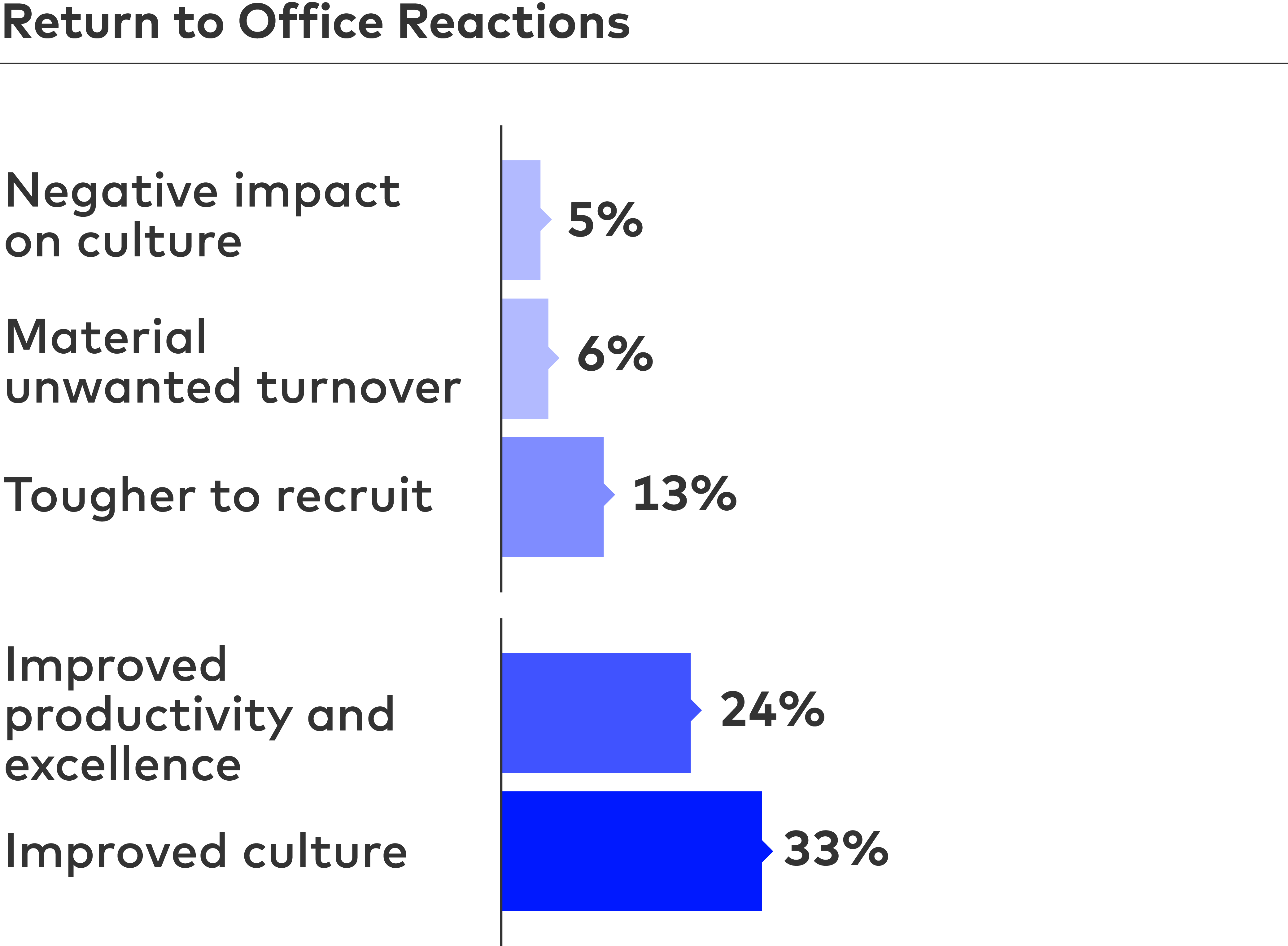

Last year, only one-third of us said that employers would increase return-to-office mandates. Now 69% are back in the office, AND few have experienced negative effects in unwanted turnover or difficulty recruiting.

DRUG WARS

From GLP-1s to CMS price negotiations, everyone is talking about drugs.

MEGA-BLOCKBUSTER

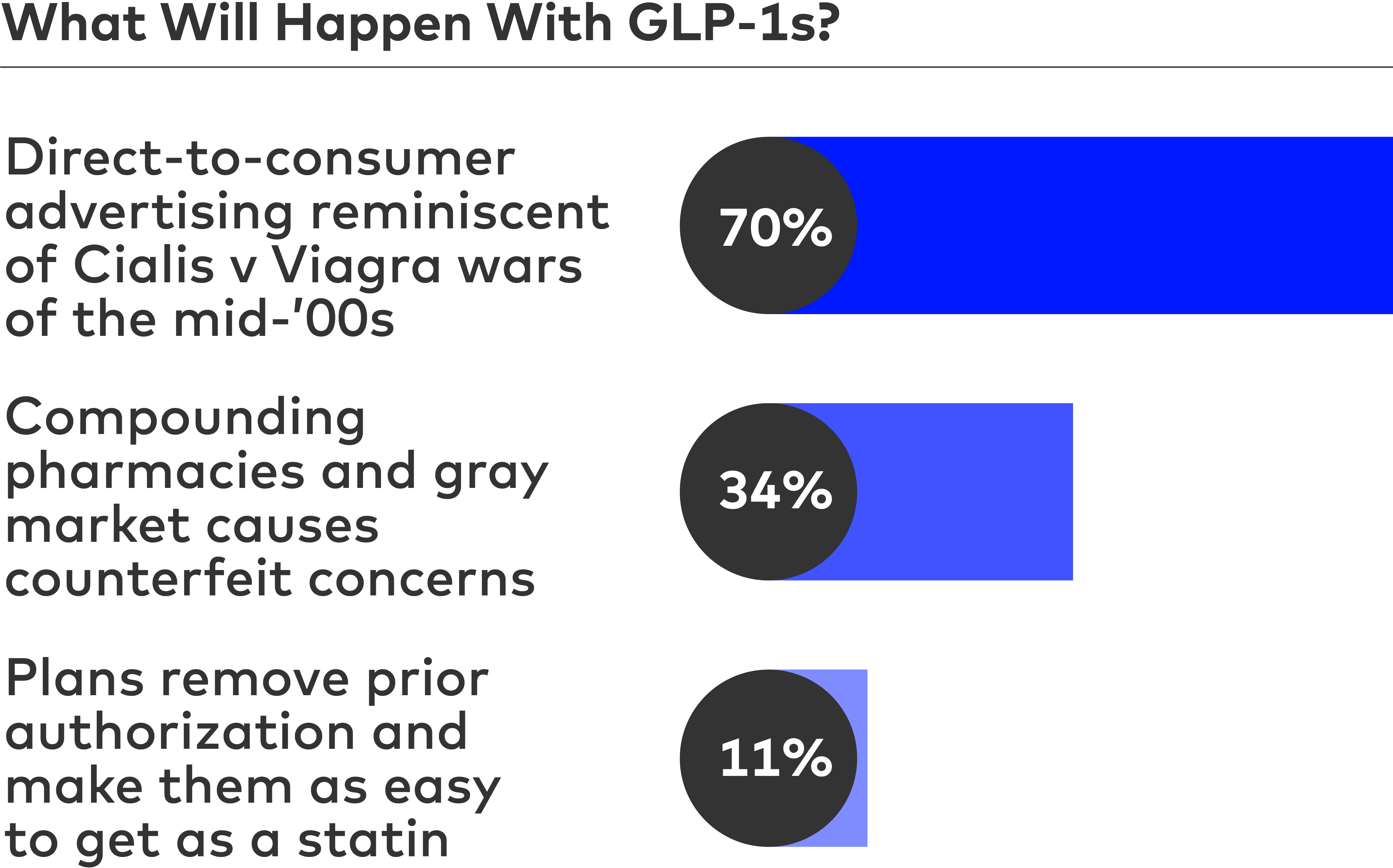

While pharma will advertise anywhere and everywhere to drive up demand, and GLP-1s will continue their meteoric rise, intensifying cost concerns will keep payors/employers scrambling. This will, in turn, spur efforts for lower cost options, including compounding pharmacies. If Medicaid spending on GLP-1s surpasses 10%, it will be difficult for states to pay, leading to additional give and take between payors and pharma.

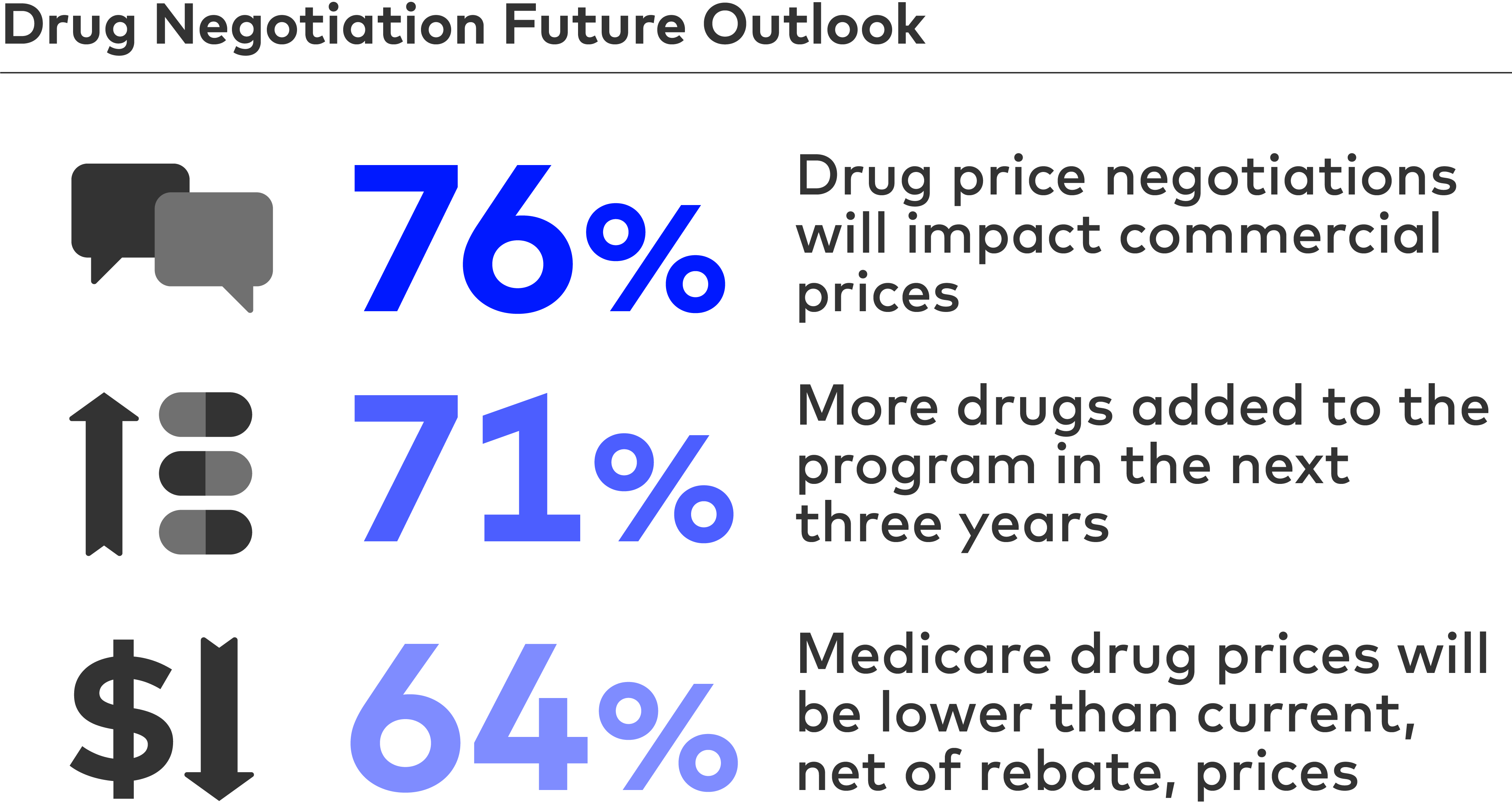

PROGRESS ON PRICES?

For years we’ve asked about efforts to lower the price of drugs in the U.S. and consensus has always been that nothing would happen. A stark difference this year… not only for lower Medicare prices, but also a reset of pricing paradigms across the commercial landscape. Drug price negotiations will be a broader policy victory than expected if this is the case, but your authors are skeptical that actual prices will end up lower than current net.

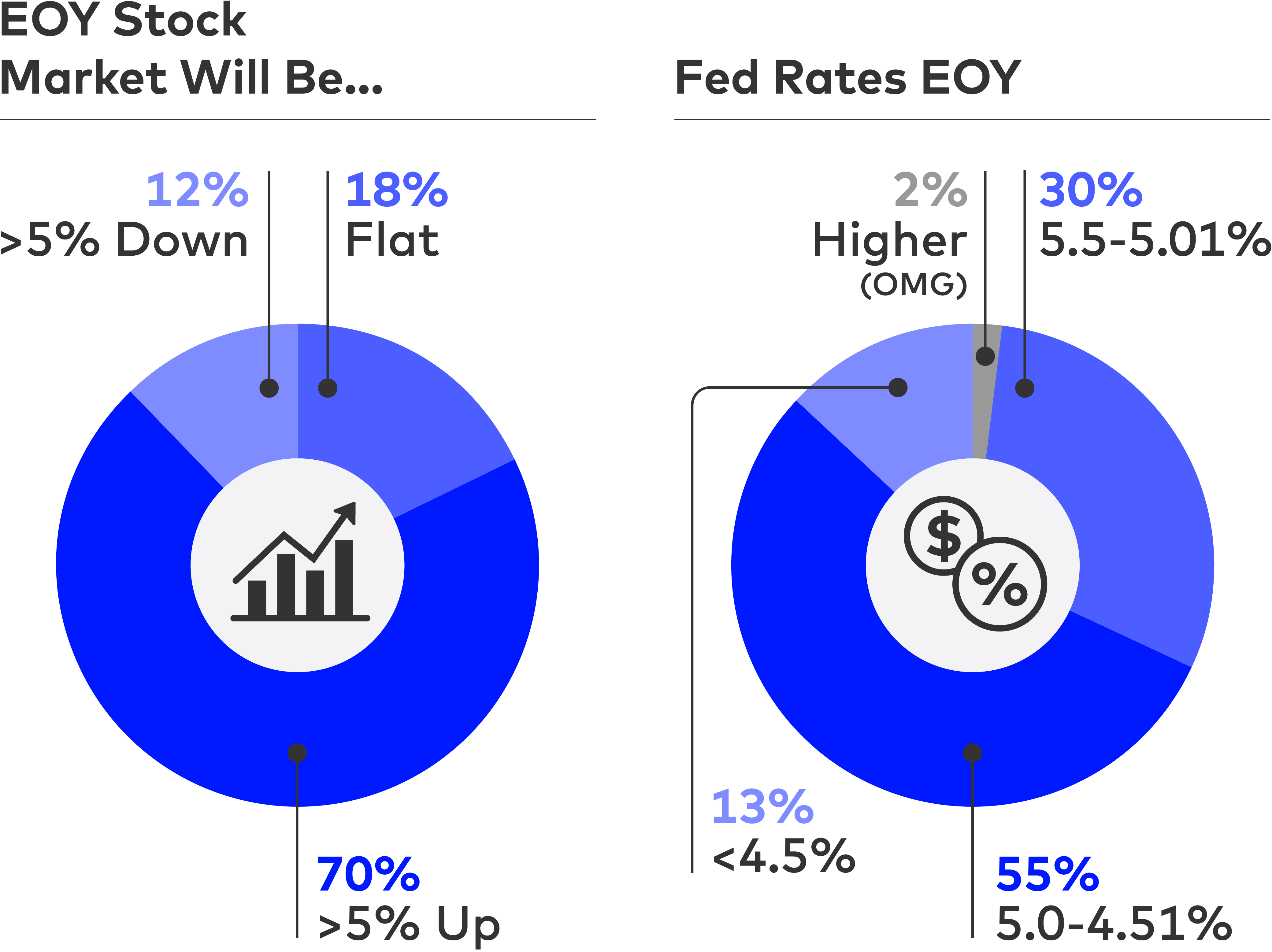

ECONOMIC OPTIMISM

High interest rates… IPOs on hold… difficult funding environment… We haven’t been able to catch a break after a (perhaps overly) delightful decade. But you all are growing increasingly more optimistic about the equity market and therefore IPO potential. Your authors are more nervous than consensus about rates…

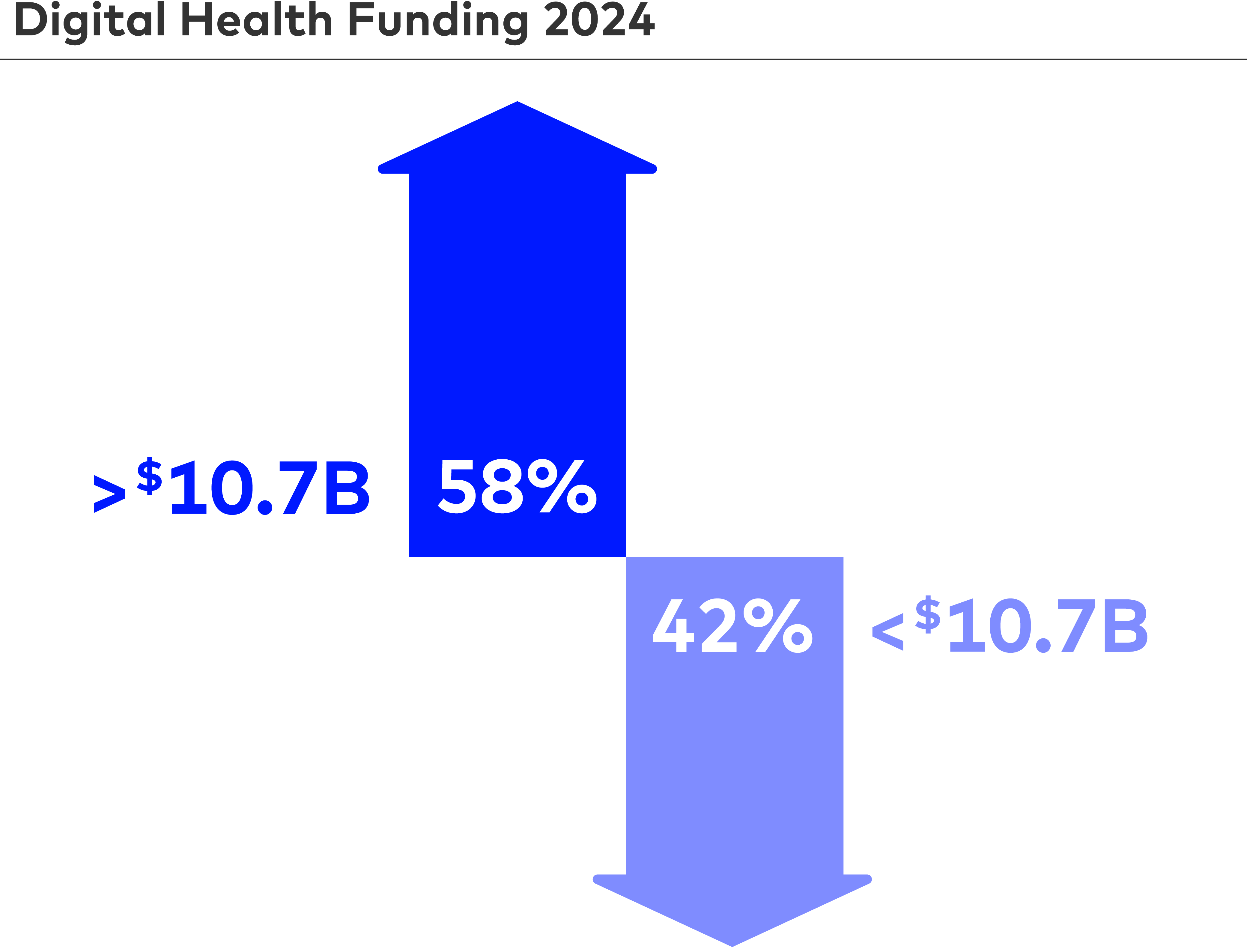

$$$

While 2023 funding for U.S. digital health startups slumped to the lowest level since 2019, the stock market has been strong based on AI and a resilient economy. Will there continue to be a bifurcation in the fortunes of health tech companies vs. the broader market?

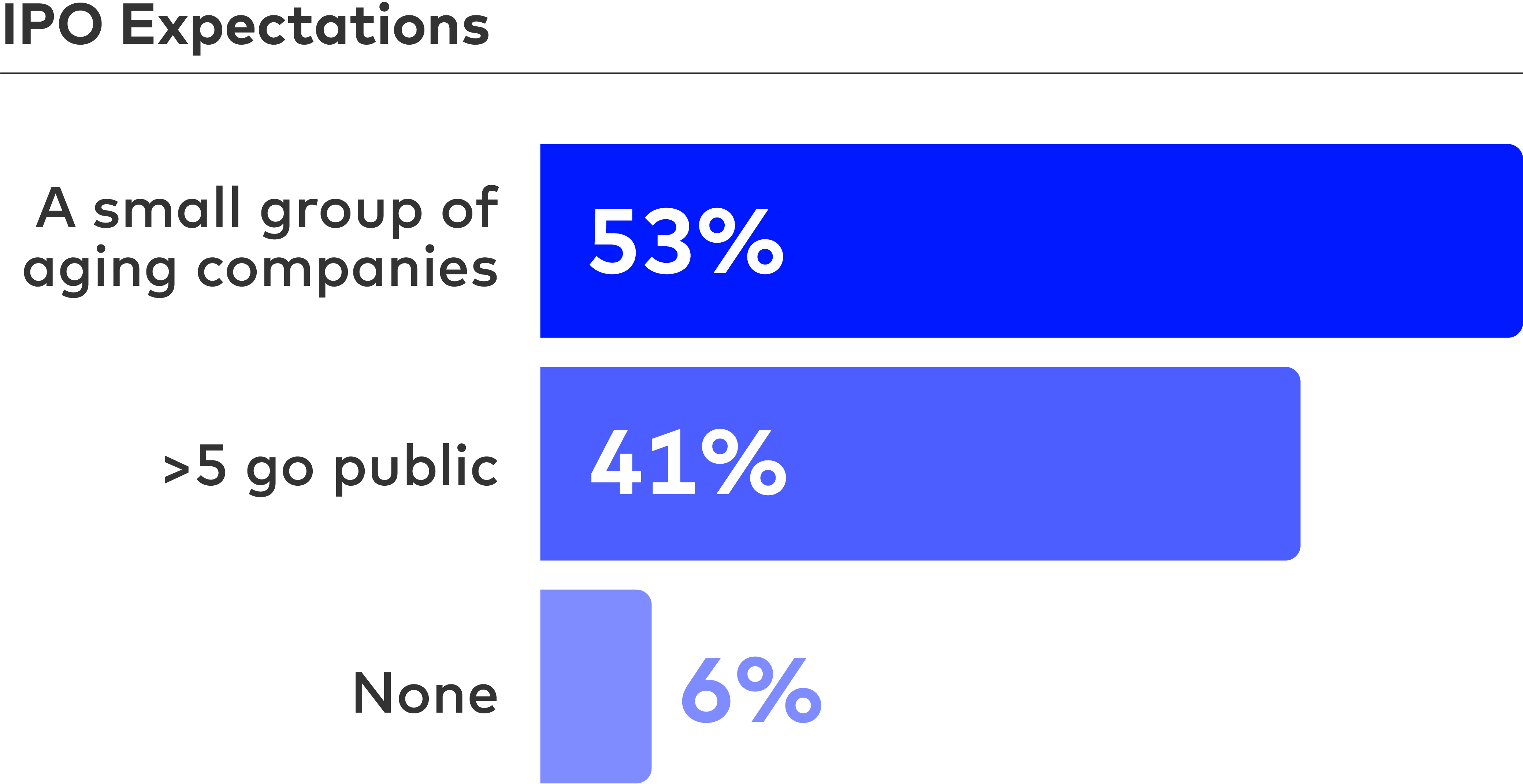

HEAD FOR THE EXITS

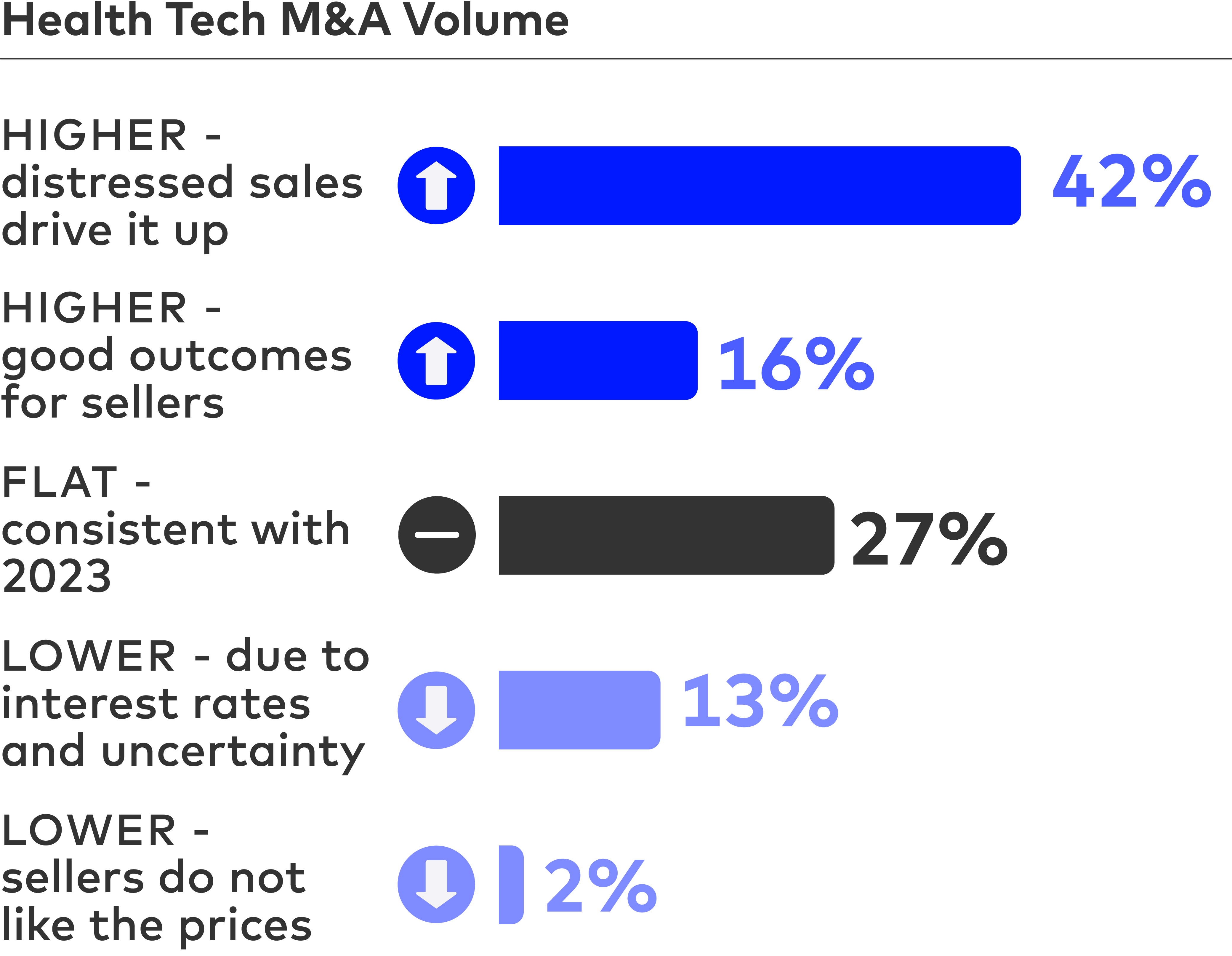

On the heels of successful IPOs like Reddit and the prediction of rate cuts, there is optimism that the IPO market is opening up. M&A may also gain momentum, but not necessarily bringing strong outcomes for sellers.

TURNS OUT UNICORNS ARE MYTHICAL

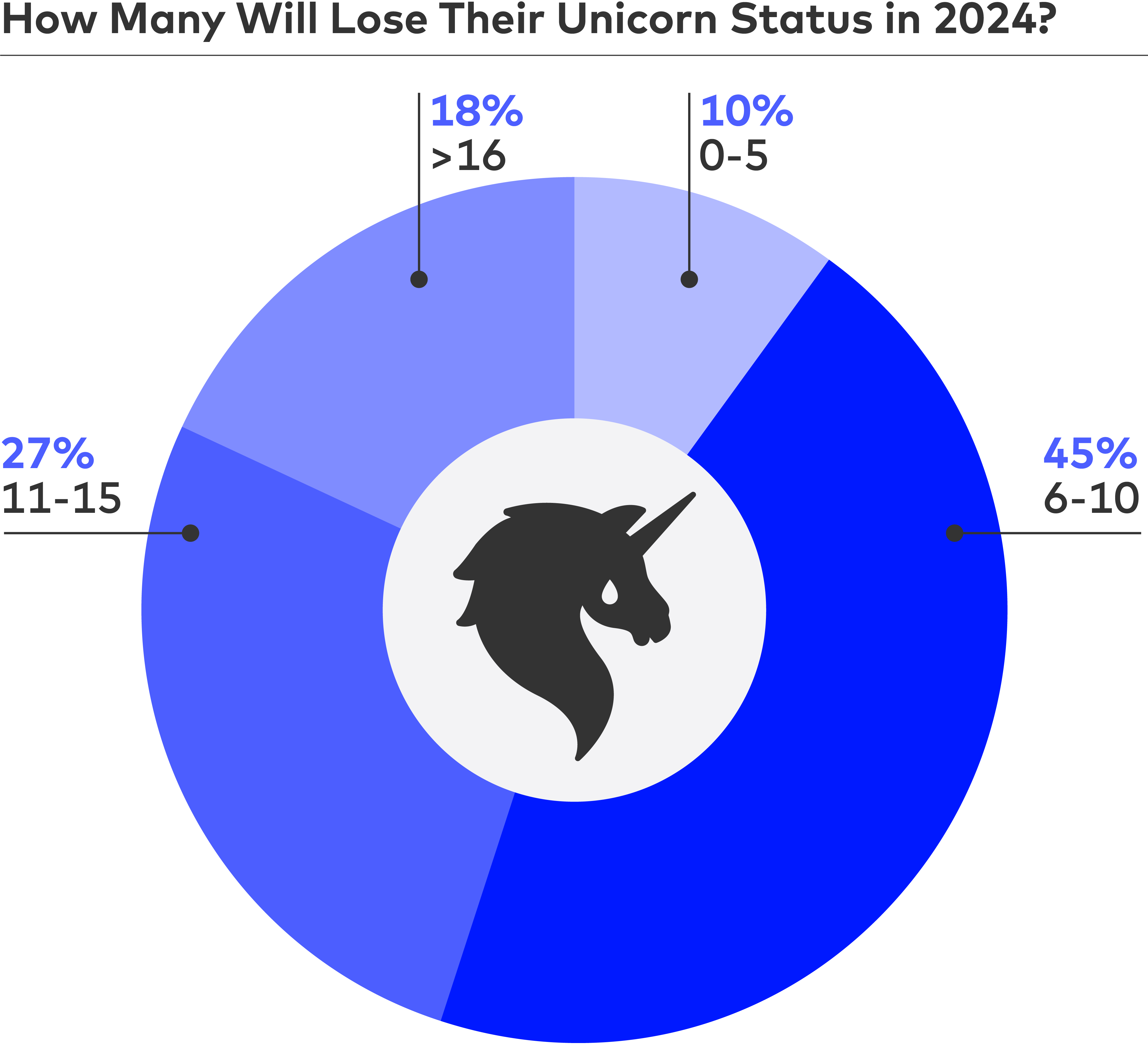

Everyone is projecting that many health tech unicorns will, or already have (Amwell), lost their status.

TRENDS IMPACTING HEALTHCARE

From Federal Trade Commission (FTC) action (or inaction) to cybersecurity concerns to AI regulation, there has been lots of chatter in the healthcare world. But actual change in the industry remains elusive and unlikely.

ALL BARK, NO BITE

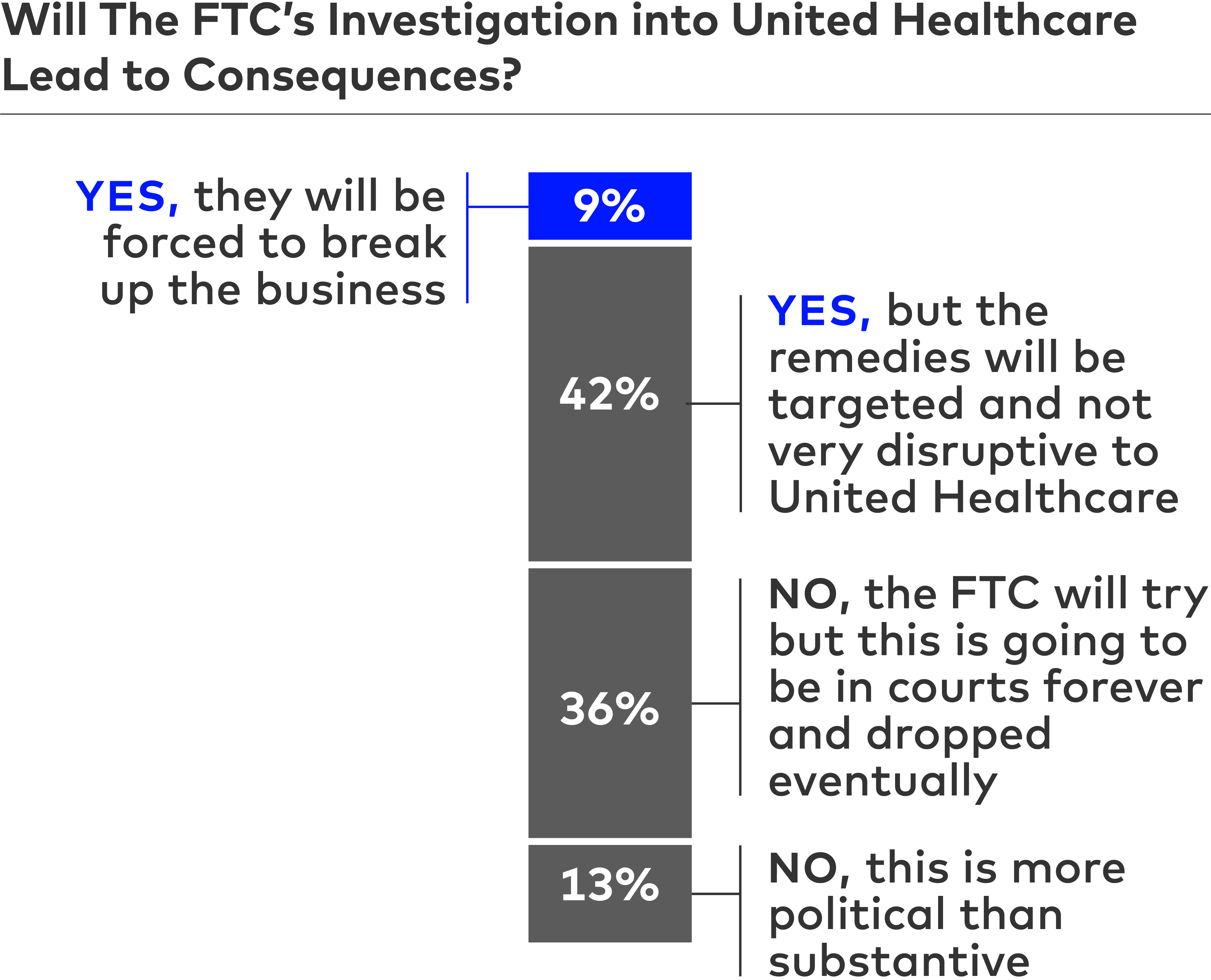

The FTC/DOJ/Congress will continue to get less actually done in healthcare. It remains that policy making and regulatory enforcement are more of a political talking point than potent intervention. Doing the hard thing, for good, should be easier. (P.S. CMS has done a really nice job recently).

CYBERATTACK CONUNDRUM

A single source failure, Change Healthcare, was disastrous and should put the entire industry on notice.

AI FOR EVERYTHING

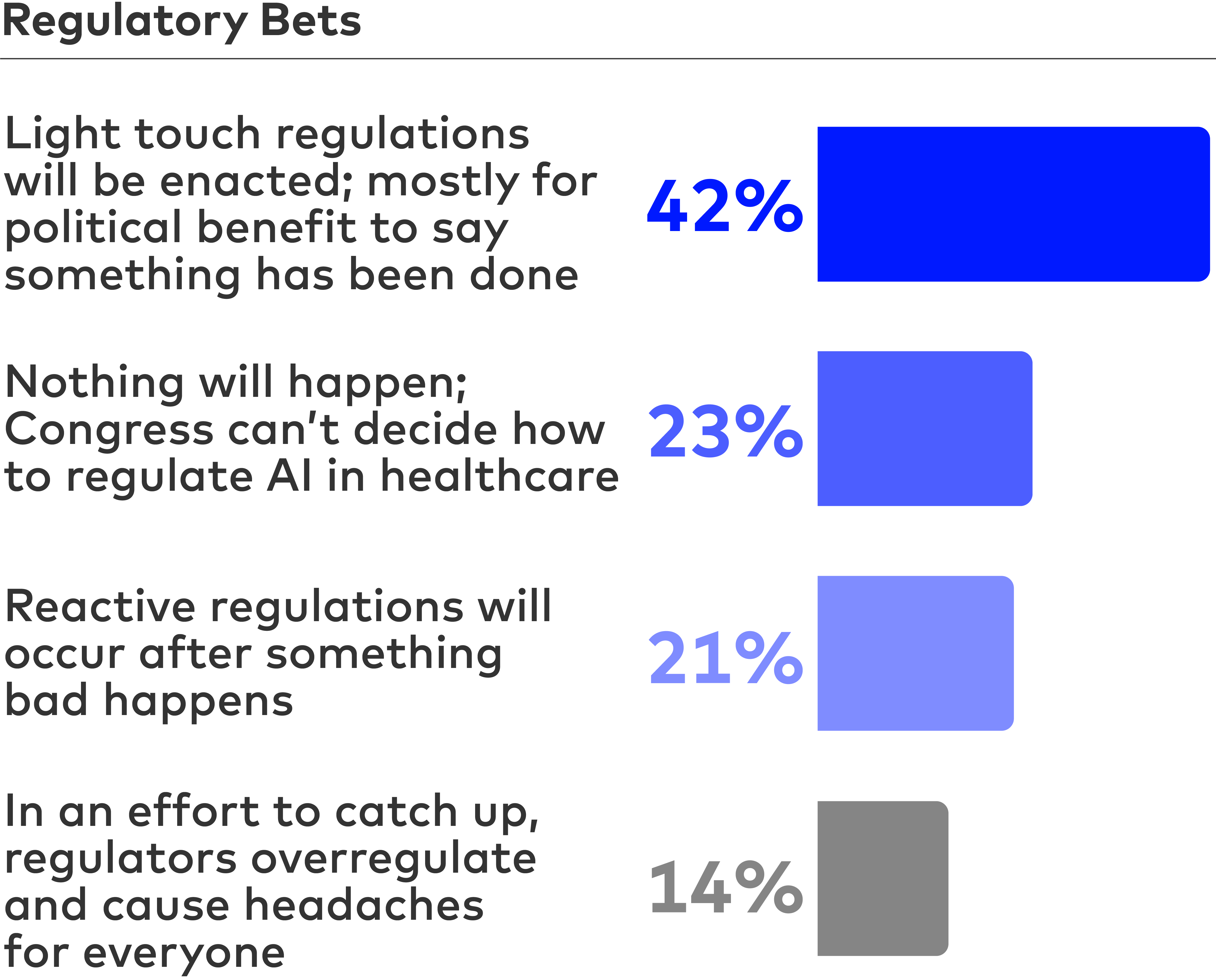

A whopping, but not shocking, 79% think AI in health tech will see material growth this year. While there has been tons of debate around regulating AI, it is believed that Congress might actually do something. That said, for years, people have wanted Section 230 - the law protecting companies from lawsuits over what is posted on their sites (e.g. Meta/Mark Zuckerberg) - to be changed, without any luck, so we aren’t holding our breath.

FULL SURVEY RESULTS

283 respondents from health tech startups, investors, high growth private companies, healthcare providers, healthcare payors, academics, and professional service providers conducted the survey between March 20, 2024, and April 2, 2024. If you would like to view the results of our previous surveys, you can find them here:

2023 Healthcare Prognosis

2022 Healthcare Prognosis

2021 Healthcare Prognosis

2020 Healthcare Prognosis

2019 Healthcare Prognosis

2018 Healthcare Prognosis

2017 Healthcare Prognosis

1

Will Covid be a material problem in 2024?

| 93% | Nope, just another communicable disease |

| 7% | We ignore Covid at our peril |

2

How have increased return to office mandates impacted your workforce?

| 6% | Material unwanted turnover |

| 13% | Tougher to recruit |

| 24% | Improved productivity and excellence |

| 33% | Improved culture |

| 5% | Negative impact on culture |

| 26% | Not a big difference |

| 31% | Not relevant. Still all/mostly virtual |

| 9% | Other |

3

GLP-1s will continue to be in the spotlight and which of the following will happen?

| 30% | Rebates will become enormous (50-80% of list price) |

| 70% | Direct-to-consumer advertising reminiscent of Cialis v Viagra wars of the mid-’00s |

| 11% | Plans remove prior authorization and make them as easy to get as a statin |

| 16% | Bad safety event scares people and lowers demand |

| 34% | Compounding pharmacies and gray market causes counterfeit concerns |

| 59% | In the next 3 years, GLP-1s will be prescribed more for other health benefits (cardiovascular diseases, liver disease, pre-diabetes) than for weight loss |

4

Will gross Medicaid (as a general proxy) spending on GLP-1s surpass 10% in 2024? (4.6% in 2022; 6.7% through Q3 2023)

| 63% | Yes |

| 37% | No |

5

Will Medicare’s drug price negotiations result in prices that are lower than the current, net of rebate, price?

| 64% | Yes |

| 36% | No |

6

Will Centers for Medicare & Medicaid Services drug price negotiations materially impact commercial prices? If so, when?

| 16% | Yes, within 2 years |

| 39% | Yes, within 5 years |

| 21% | Yes, but will take even longer than 5 years |

| 19% | Not on a net basis, but will throw the rebate game into chaos |

| 5% | No |

7

Medicare drug price negotiations have been a political success. What will happen to the program in the next 3 years?

| 71% | More drugs added (e.g., Biden has proposed expanding to 50 drugs per year) |

| 26% | Program stays the same |

| 3% | Program is eliminated by Congress |

8

Will the Federal Trade Commission (FTC) antitrust investigation into United Healthcare lead to big consequences?

| 9% | Yes, they will be forced to break up the business (perhaps with the Change Healthcare cyber attack used as evidence that they are too big/influential) |

| 42% | Yes, but the remedies will be targeted and not very disruptive to United Healthcare |

| 36% | No, the FTC will try but this is going to be in courts forever and dropped eventually |

| 13% | No, this is more political than substantive |

9

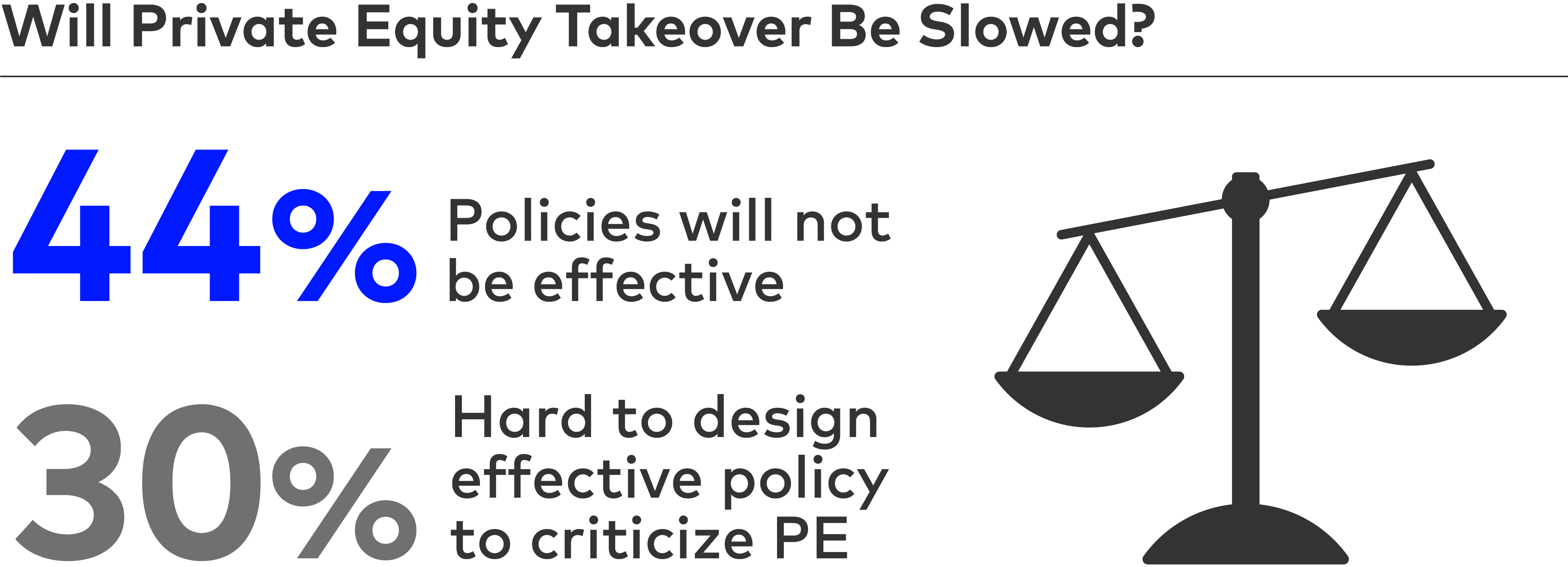

Will the FTC and Biden Administration establish policies designed to reduce private equity (PE) takeover activity and price gouging in healthcare services?

| 9% | Yes, they will go after PE and go further by trying to block hospitals from raising prices when they acquire doctors |

| 17% | Yes, they will target PE specialty care roll-ups |

| 44% | Yes, but the policies will not be effective |

| 30% | No, it is hard to design an effective policy to criticize PE |

10

The Change Healthcare cyberattack crippled the eligibility and payments infrastructure and was reported to result in a $22M ransom payment. Will the success of this hack embolden bad actors and result in even more disruptive attacks in healthcare?

| 74% | Yes, we should expect more successful attacks on core healthcare infrastructure |

| 21% | Yes, but they will not be as bad as Change (limited to a single market or player) |

| 4% | No, Change was uniquely big and vulnerable |

| 1% | No, our cybersecurity programs are effective |

11

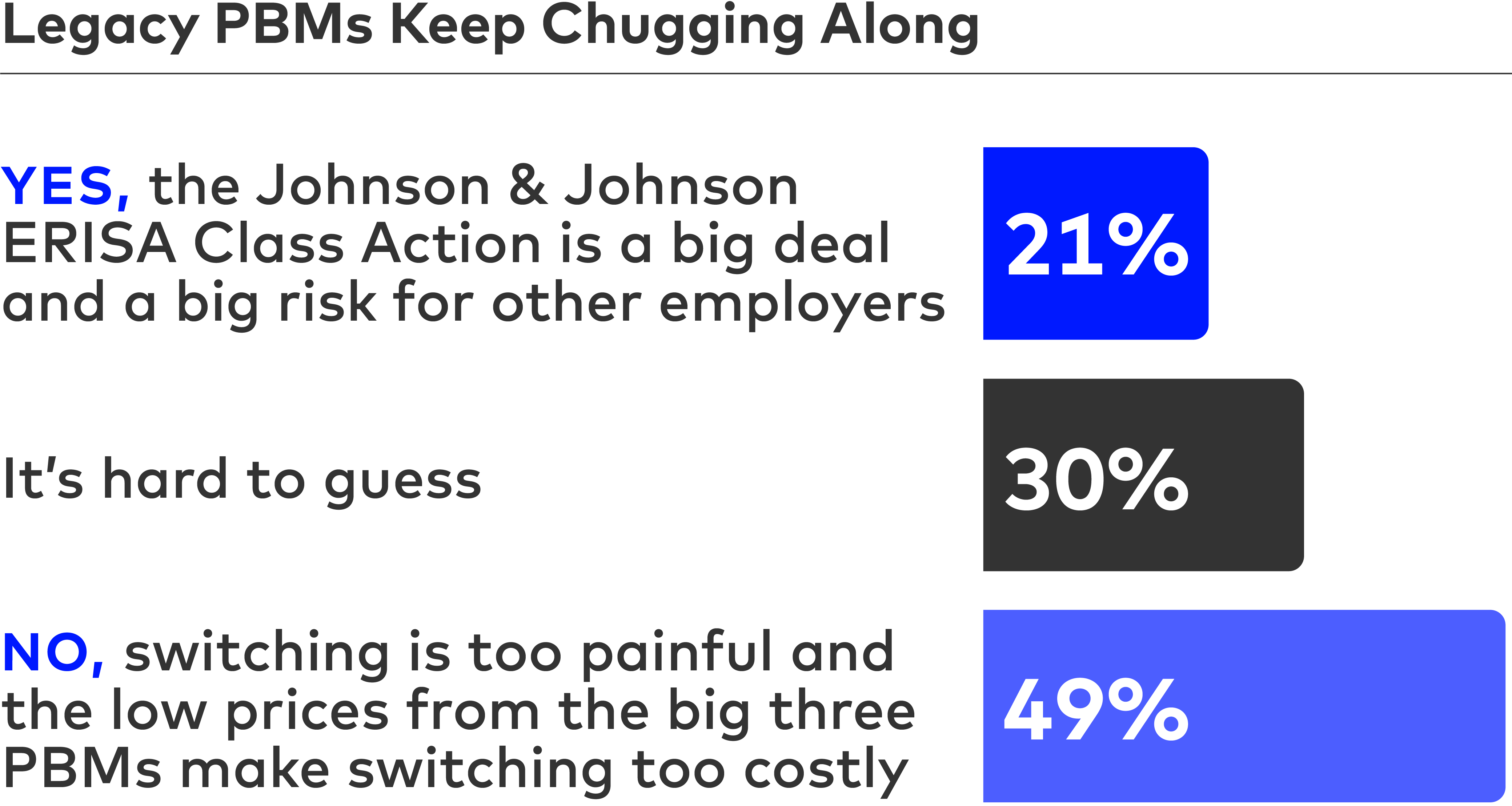

Will large employers begin to drop the big three pharmacy benefit managers (PBMs)?

| 21% | Yes, the Johnson & Johnson ERISA Class Action is a big deal and a big risk for other employers |

| 49% | No, switching is too painful and the low prices from the big three PBMs make switching too costly |

| 30% | It’s hard to guess |

12

The U.S. stock market (3/18/24 NASDAQ close: 16,103.45) will end 2024…

| 18% | Flat |

| 70% | Up by more than 5% |

| 12% | Down by more than 5% |

13

End of year Fed rates will be… (It is currently 5.5%)

| 2% | Higher (OMG) |

| 30% | 5.5-5.01% |

| 55% | 5.0-4.51% |

| 13% | <4.5% |

14

How many venture capital ecosystem (not PE) initial public offerings will there be in 2024?

| 6% | None |

| 53% | A small group of aging companies with a lot of revenue make it out |

| 41% | The window opens and >5 succeed at going public |

15

Every Medicare Advantage payor and risk bearing group saw outpatient spending grow more than expected in the second half of 2023. In 2024 spending will…

| 14% | Revert to the mean |

| 59% | Remain elevated |

| 25% | Remain elevated, but value-based care groups will overperform compared to fee-for-service providers |

| 2% | Go down, below the mean |

16

Village MD has many fewer clinics in 2024 than 2023. Will Oak Street have more or fewer clinics by EOY 2024 v 2023 (Ended 2023 with 204 clinics)?

| 23% | More |

| 45% | Less |

| 32% | Same |

17

Hospital operating earnings in 2024 will be…

| 25% | Lower - admissions keep falling and they cannot make it up from outpatient business |

| 25% | Higher - the shift to outpatient care is higher margin and more than offsets lower inpatient admissions |

| 18% | Higher - inpatient admissions recover and outpatient remains strong |

| 32% | There won’t be a significant change from 2023 |

18

Will Medicare Advantage payors reduce benefit generosity in 2024?

| 14% | Not at all - this is a chance to take market share |

| 67% | Modest decrease - it is still a relatively more attractive segment and growth is good |

| 19% | A ton - Risk Adjustment Model Version 28 changes and high outpatient spend are huge headwinds |

19

At least one large payor CEO will lose their job as a result of sustained poor performance in the government business (Medicare Advantage, Medicaid, value-based care) in 2024.

| 62% | True |

| 38% | False |

20

In 2024, the number of US-based health tech M&A transactions will be (2023: 268 HCIT deals)...

| 42% | Higher - but distressed sales drive it up |

| 16% | Higher - and the outcomes are good for sellers |

| 27% | Flat - transaction volume will remain consistent with 2023 |

| 13% | Lower - higher interest rates and economic uncertainty makes acquirers cautious |

| 2% | Lower - sellers do not like the prices offered |

21

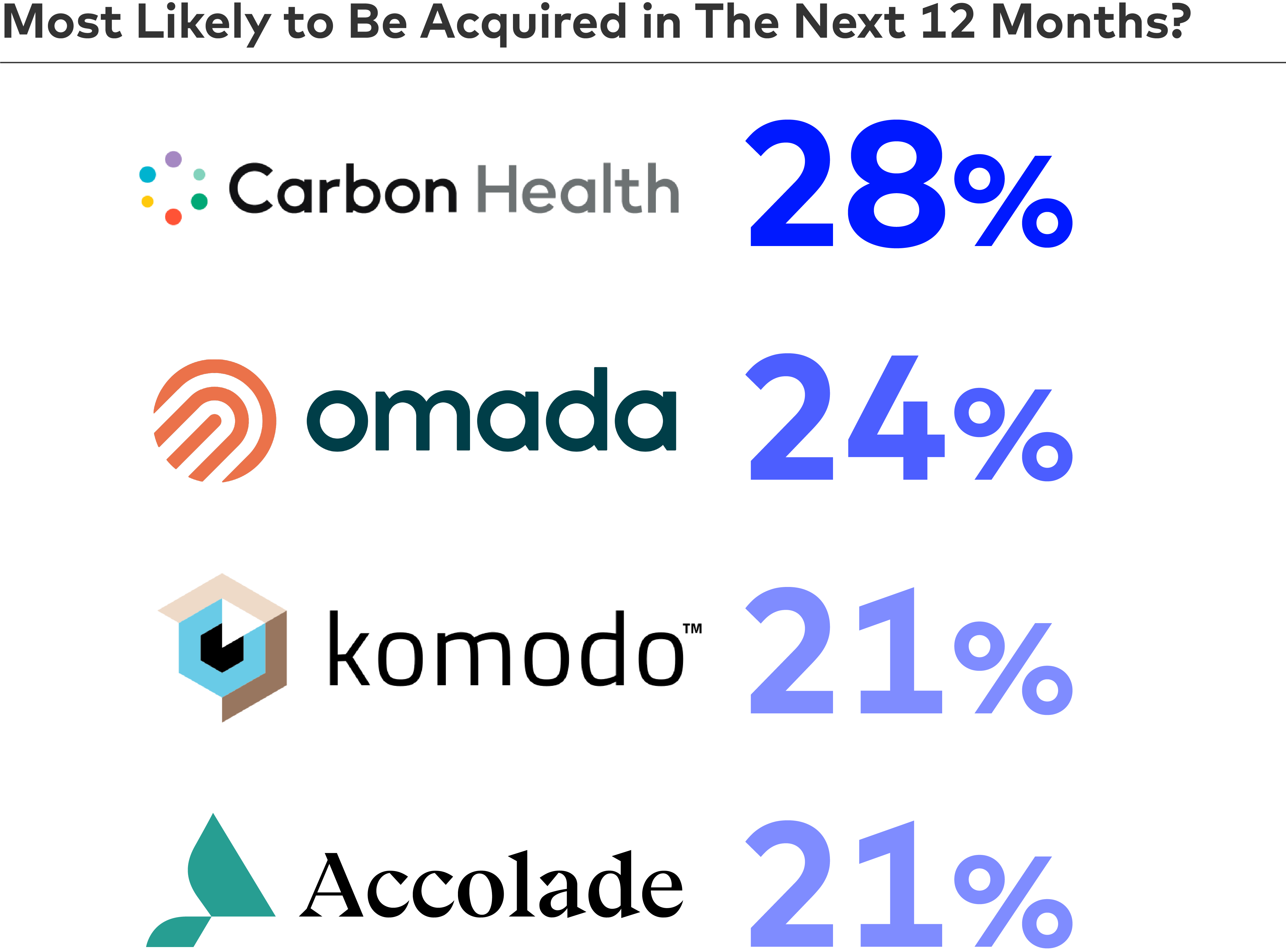

Which later stage private / small cap public companies are most likely to be acquired, in the next 12 months?

| 14% | Hinge Health |

| 15% | Sword Health |

| 9% | Color |

| 20% | Noom |

| 21% | Komodo Health |

| 14% | Cedar |

| 11% | Spring Health |

| 14% | Somatus |

| 28% | Carbon Health |

| 6% | Forward |

| 24% | Omada Health |

| 21% | Accolade |

| 16% | Calm |

| 7% | Other (fill-in) |

22

X BIAS ALERT - When we asked you which companies that are expected to go public in the near future will be the most successful public companies in 5 years, the responses overwhelmingly swayed in favor of Venrock portfolio companies. Given the likely bias in our survey pool, we scrubbed this question.

23

The number of health tech unicorns to lose their horns in 2024 will be (70 total digital health unicorns, as of 10/23):

| 10% | 0-5 |

| 45% | 6-10 |

| 27% | 11-15 |

| 18% | >16 |

24

What area(s) of healthcare will see the most generative artificial intelligence (AI) advancements this year?

| 77% | Administrative tasks (customer service, payor/provider operations) |

| 23% | Cancer care and genomic interpretation |

| 27% | Drug development |

| 19% | Clinical trial recruitment |

| 58% | Electronic Medical Record documentation and chart reviews |

| 13% | AI automated mental health care |

| 29% | Remote patient monitoring / monitoring patient data feeds |

| 62% | Image processes (pathology slides, radiology) |

| 1% | Other (please specify) |

25

Which of the following health tech sectors will experience material growth in the next 12 months?

| 24% | Accountable Care Organizations / value-based care |

| 21% | Medicare Advantage |

| 15% | Medicaid |

| 79% | Generative AI, Analytics, and Big Data |

| 17% | Digital Preventative Care Programs / Wellness |

| 13% | Electronic Health Records |

| 8% | Health Insurance |

| 27% | Virtual Care / Telemedicine |

| 19% | Wearables |

| 24% | Direct-to-consumer services |

26

Who will dominate the healthcare cloud space?

| 32% | Microsoft (+Nuance) |

| 23% | Amazon |

| 5% | |

| 2% | Oracle |

| 37% | No clear winner |

| 1% | Other (fill-in) |

27

Funding for digital health startups slumped to $10.7B in 2023, the lowest amount of capital invested in U.S.-based digital health startups since 2019. In 2024, funding for digital health startups will be…

| 7% | More than $15B |

| 51% | Between $10.7B - 14.9B |

| 25% | Between $9.6B - 10.6B |

| 17% | Less than $9.5B |

28

Who will win the 2024 Presidential election?

| 62% | Biden |

| 35% | Trump |

| 3% | Other (fill-in) |

29

How will the results of the 2024 Presidential election impact the future of the U.S. healthcare system?

| 24% | Positively |

| 54% | It won’t make a difference |

| 22% | Negatively |

30

In 2024, women’s reproductive rights will continue to erode in many states (Mifepristone, IVF embryos).

| 63% | True |

| 37% | False |

31

How will regulations around AI in healthcare play out?

| 14% | In an effort to catch up, regulators overregulate and cause headaches for everyone |

| 42% | Light touch regulations will be enacted; mostly for political benefit to say something has been done |

| 21% | Reactive regulation will occur after something bad happens |

| 23% | Nothing will happen; Congress can’t decide how to regulate AI in healthcare |

32

Which category best describes your employer?

| 4% | Academia |

| 27% | Investor |

| 26% | High growth private company/startup |

| 4% | Healthcare provider |

| 4% | Healthcare payor |

| 18% | Life sciences |

| 10% | Professional services |

| 7% | Other |